EK ADVISORY SERVICES

EK ADVISORY SERVICES

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

- Insolvency

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

- Insolvency

DEBT RECOVERY & RESTRUCTURING

Emilianides Katsaros is extremely strong in the banking sector, with a deeply experienced team. Our firm achieved to incorporate complex financing techniques and fresh ideas that lead the banking and finance industry.

During the past years, Cyprus faced one of the most challenging economic crises in Europe. The Cypriot financial market required first-of-a-kind solutions, quick and effective methods for fighting the crisis. Our law firm was one of the pioneers in drawing local and multidisciplinary skills to provide advice on all aspects of restructuring and insolvency, and critical tax issues.

Our firm, actively participated in the committee for the amendment of the Transfer and Mortgage Law No. 9/1965, which introduced the term of private auctions. Today, credit institutions benefit from the aforementioned legislation, as the foreclosure procedure constitutes one of the most effective tools of debt recovery.

Another strong method of debt restructuring and recovery, is the Debt for Asset Swap (DFAS), method. Our firm was the first law firm in Cyprus to implement the DFAS procedure for one of the major banking institutions of Cyprus and our advisory consultants are experienced in handling all stages of the DFAS procedure.

Therefore, our highly qualified members are often hosting seminars for the Association of Cyprus Banks and our financial institutions clients, regarding new legislations and/or complex banking matters. What is more, our clients, including credit-acquiring companies, entrust us with undertaking the process of risk assessment of loan portfolios they consider buying.

Through our expertise over the years, we managed to quickly build groups offering in-house services tailored to the needs of our high-profile clients. Needless to say, that if the in-house solution is not of your preference, our expanding department proficiently undertakes outsourced, large-scale projects as well.

Whether you need strong litigation representation or out-of-court assistance, our team members with a yes-I-can attitude will assist you promptly.

Debt Recovery

Our experienced and dedicated advisory consultants provide pioneering solutions as well as deliver real results.

We can assist you in investigating the financial status of the debtor and based on our findings, prepare the optimal recovery plan.

Our services include:

- Negotiation Assistance

- Drafting settlement agreements, sale-and-purchase agreements, escrow agreements, rental agreements etc.

- Drafting of banking documents (facility agreements, security agreements, demand letters)

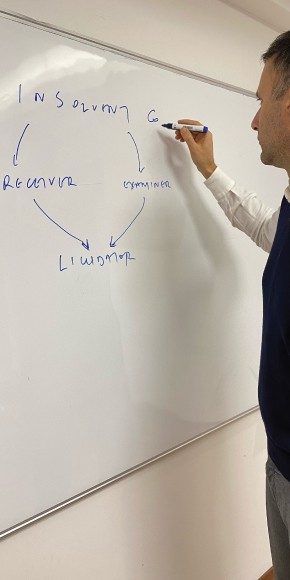

- Insolvency practitioners

- Appointment of insolvency practitioners

- Bankruptcy and insolvency

- Corporate refinancing and restructuring

- Real estate finance

Restructuring

We assist our clients in preparing a business plan that will constitute the foundation of a successful restructuring plan, providing all necessary support. Through our knowledge and expertise, we can advise our clients so as to achieve the optimal restructuring solution.

Our services include:

- Restructuring plans

- Negotiation assistance

- Appointments of Receivers/Liquidators/Examiners

- Debt to asset swaps

- Foreclosure proceedings

- Settlement Agreements